In Mark Twain’s 1873 novel The Gilded Age: A Tale of Today, co-written with his neighbor Charles Dudley Warner, Twain describes cycles as follows: “History never repeats itself, but the Kaleidoscopic combinations of the pictured present often seem to be constructed out of the broken fragments of antique legends.”

So, if there is one inescapable fact, it is that time and life move incessantly and in cycles. Night follows day, empires flourish and decay, seasons come and go and economies expand and contract. The natural order of change is a continuous cycle. All you can do is prepare for change. As economies move in cycles, all you can do is to learn to balance your personal finances to be weatherproof while yielding a healthy return on your capital.

Before we delve into economic cycles, let us begin by laying some ground rules first. First, you must embrace the fact that cycles are inevitable and use your judgment to discern your place in the overall economic cycle. Second, one of the most fundamental principles of macroeconomics (or a top-down study of economies) is that it offers frameworks to analyze economic cycles. Therefore, it is as much art as science. Over time, you have to develop your own judgment while learning about the controversies surrounding different explanations or frameworks. Third, any model is based on assumptions and empirical evidence. As models evolve, new data emerges of radically different ways of looking at economic phenomena develop, older frameworks will be challenged and could change.

These three principles provide a starting point to start analyzing the economic. Imagine if you were in a chicken-and-egg situation and you have no idea where to begin analyzing a cycle, it would be utter chaos. Thus, a starting point is of paramount importance. The beauty of a cycle is that any starting point is good enough. In a typical capitalist economy, there are three basic actors (entities that interact with each other to keep the economy going): the producers, the consumers who consume the products and services offered for sale by the producers, and the government.

In general, producers employ four factors of production to manufacture and ‘supply’ goods to consumers, i.e., land, labor (L), capital (K) and their own talent. The monetary value, at which these goods exchange hands from the producer to the consumer, is called the price. An ‘equilibrium’ price is determined where the quantity of goods demanded from the consumers meets the supply of goods by the producer. Any change in the demand or supply results in a change in price. In simple terms, increase in demand while supply is constant raises the price. Prices fall when supply increases with constant demand.

The government, perhaps, is the most controversial of these actors as people have different opinions on the extent to which government should be involved in the economy. A certain section of thinkers argues for an economy with lesser government control. Such an economy is also known as a ‘laissez-faire’ economy. The polar opposite of a laissez-faire economy is a socialist economy where the government controls everything.

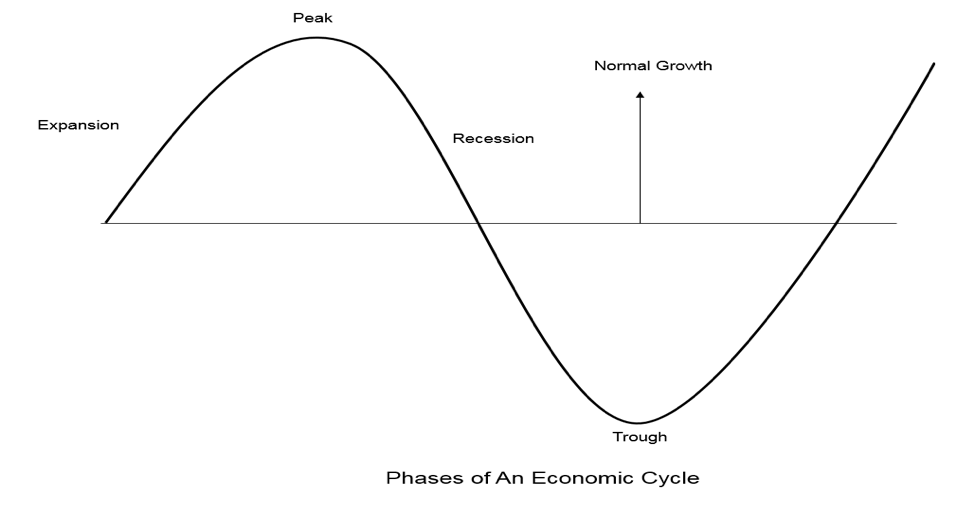

An economic cycle, also known as a business cycle typically, has four phases i.e. expansion (booms), peaks, contractions (recessions) and troughs. The first two phases, i.e., expansion and peaks signify periods of relatively rapid economic growth. The other two phases, i.e., recessions and troughs represent periods of relative stagnation and decline. The length of economic/business cycles varies depending on different explanations.

Let us look at one explanation of an economic cycle. Expansions are typically periods characterized by low-interest rates, i.e, the central banks (the US Federal Reserve) lending money to other banks at low-interest rates. The other banks, in turn, offering loans at lower interest rates to producers and consumers. This results in too much money in the system chasing relatively fewer assets in supply resulting in rising prices. The producers respond by producing more but ‘cheap money’ outpaces supply and prices become unsustainable. After a point, high prices put political pressure on the government and signal ‘peak’ expansion or ‘over-heating’ of the economy. This results in tightening of monetary policy by the central bank, i.e., it raises interest rates making borrowing expensive for everyone, thereby reducing demand and lowering prices resulting in a deceleration of supply (output by producers) followed by a recession or period of slowdown in GDP growth. If the slowdown lasts for more than a few months, the National Bureau of Economic Research (NBER), which is the official arbiter of business cycles, announces a recession. The NBER identifies a recession as “a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production.”

There are two schools of thought that are engaged in a constant debate on what influences or causes economic cycles. The Keynesian school of thought (also known as ‘demand-side’ economics) believes internal factors such as changes in consumer demand causes cycles whereas the neo-classical school (also known as supply-side economics) believes that exogenous factors such as technology and government intervention are the primary causes of movements from one stage of an economic cycle to the other. The supply-side economists believe in less government intervention because they believe the markets take care of themselves, whereas the Keynesian school thinks that without government intervention, economies may move from one crisis to another. In fact, the government rescued many of the systemically important financial institutions by offering bailouts after the 2008 sub-prime crisis through a program called the ‘Troubled Assets Relief Program (TARP).’ While the debate rages on, there lies a possibility that the truth lies somewhere in between.

A popular option for looking at predicting economic cycles is to look at short term and long term interest rates (denoted by yield curves). In finance, the yield curve is a curve showing several yields or interest rates across different contract lengths for a similar debt contract. Typically, long-term interest rate (yield on 10-year bonds) is higher than short-term interest rates (i.e., the yield on 2-year bonds) because of the time value of money. In a growing, inflationary economy, the longer you lend someone money, the higher the price (interest) you want on the loan because of the increased uncertainty. This principle makes the normal yield curve, over time, upward sloping. But, if it is ‘inverted’ or downward sloping, it might be a signal that a recession is coming soon. By the logic of the yield-curve approach, we may be very close to an oncoming recession because the spreads (the difference between the short -term and long-term interest rates) is close to zero, i.e., we are very close to an inverted yield curve.

Having understood the basics of economic cycles, the next logical is to examine how these cycles affect our daily lives and investment choices. In the second part of this three-part mini-series, we will explore the fundamental signs of an economic expansion, understand expansion from the point of view of the various economic actors (producers, consumers, and the government) and understand the basics of portfolio construction in an expansionary economy.