The Lender of Last Resort

January 31, 2019

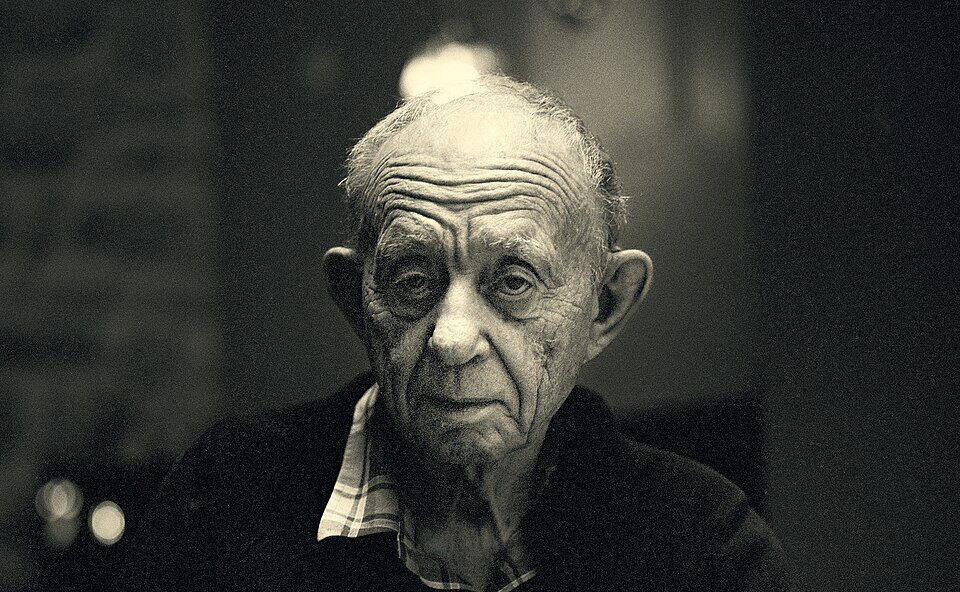

To know my granddad John Dee Hammond, you would first need to know about the little wooden lockbox, painted two shades of grey, dove and ash, affixed to the exterior of his modest two-bedroom, one-bathroom house in Clinton, Missouri. The modest lockbox was secured, and I use that verb loosely, with a lock I might have put on one of my girlhood diaries. Granddad’s lock was not “tough under fire,” as a leading lock manufacturer boasts of its product’s impenetrability. The lock, truthfully, was more for show than security. With a set of needle-nose pliers, I, or anyone else who knew what the box held, could have easily broken the lock.

Before we get to what was in the box, let me first introduce you to Clinton, a town of less than 10,000 people in west-central Missouri. Clinton is probably best known as the place where the Katy Trail begins. The Missouri-Kansas-Texas Railroad—the MKT, known simply as the Katy—stretches 240 miles across central Missouri, and is the “largest unbroken rail trail corridor in the country.” The train line turned biking and walking path once connected the midsection of Missouri to Kansas City, most of Oklahoma, and once reached deep into Texas, connecting Dallas-Fort Worth, San Antonio, Waco, and Galveston.

Clinton’s notable native sons include 1984 Olympic boxing silver medalist Virgil “Quicksilver” Hill, who was born in Clinton but raised in Grand Forks, North Dakota, and David L. Steward, the founder and chairman of billion-dollar company Worldwide Technology, Inc., the largest African-American owned company in the United States.

To be certain, Clinton was not a kind place to grow up poor or black. Steward remembers in his book, Doing Business by the Good Book, the oppressive racism of Clinton and how he and his friends finally integrated the public pool in 1967. Clinton, like many small Midwestern towns, did not, does not, exist as an unsullied Rockwellian visage of quaint Americana. There is a hard history here that asks all of us to reconcile our hate, to account for what we did and, more likely, what we did not do.

My granddad John was not born in Clinton, but spent most of his golden years, retired from the Missouri Division of Employment Security, where he, a World War 2 U.S. Navy veteran who saw action as a gunner’s mate on the beaches of Normandy, would help unemployed people find jobs. He never made more than $12 an hour, but somehow amassed well over a million dollars in cash and assets before he died seven years ago this March. Like many children who grew up during the Great Depression, he saw wastefulness as one of the biggest sins of our culture. He knew what it meant to live without, to have nothing more than blackberries off the vine for breakfast, if that, and what it felt like as a child to hold his first silver dime for threshing wheat.

One of the ways my granddad continued to make money in retirement was to serve as one of Clinton’s “lenders of last resort,” a role typically reserved for a country’s central bank to bail-out an economy, much as the U.S. federal government did in 2008. The big difference, of course, is that my granddad helped people, with interest, of course, who could not get a loan from a bank. These people had names, though sometimes my grandfather would bestow a nickname. The “River Rat” was a client who lived in a single-wide trailer close to Pomme de Terre Lake or the South Grand River. The “Hard-workers” were a young couple who worked at a factory and in retail and had small children. The “Buffet Manager” had also taken out a loan, which he paid for in principal and interest and free monthly passes to eat fried catfish, mashed potatoes and gravy, green beans simmered with bacon and onions, and peach cobbler with vanilla ice cream.

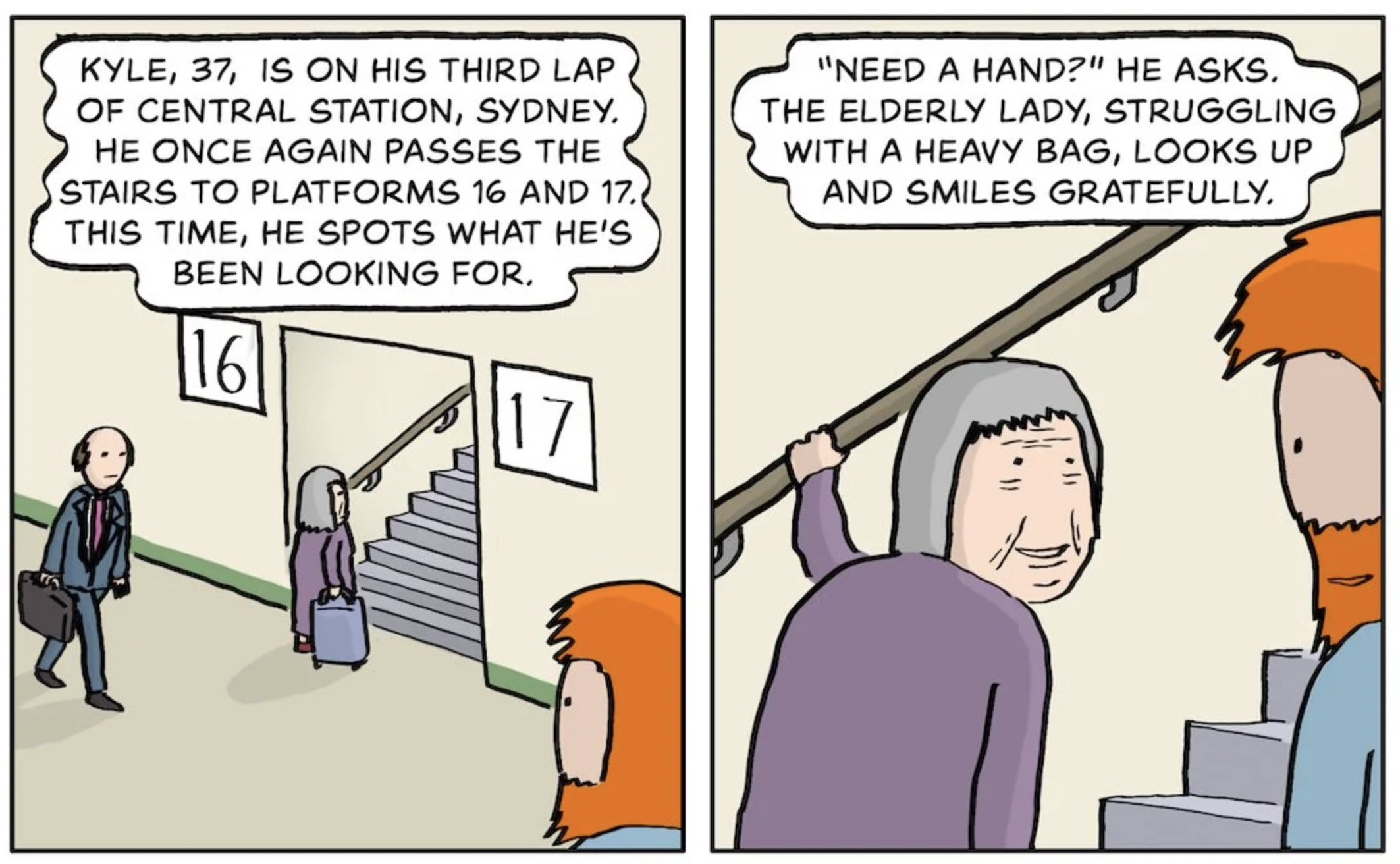

Many of these people would hand my granddad envelopes full of money when they would see him running errands around town. Or they would deposit their checks into my granddad’s little wooden box on Franklin Street. Despite painful arthritis, my granddad would bound from his La-Z-Boy recliner several times a day to see if the River Rat, the young couple, or the buffet manager had deposited their monthly check. My granddad did not use QuickBooks or a computer, for that matter. Every financial transaction was handwritten in pencil in a brown ledger.

When my granddad died, my uncle took over the accounts, and knowing what I know of my father’s brother, he likely did not grant grace periods or reprieves when work was slow or non-existent. He most certainly did not use the free passes to the family buffet. My uncle, I am sure, more closely resembled the banks that would not give loans to the working poor people my granddad and the rest of his family had come from.

After my grandfather’s death, the house where he bided his time watching The 700 Club and The Weather Channel was sold. I assume the wooden lockbox remained when the title was transferred. I often wonder if the new homeowners took the box off the house and what happened to the borrowers. Are they making do? Has their lot in life improved? Regardless, I am sure that lock is long gone, no longer sitting impotent watch over the hard-earned money of the working class.