Capitalist Fervor

January 12, 2022

The highs. The lows. The toast breaks. It has been a dizzying day of being a capitalist.

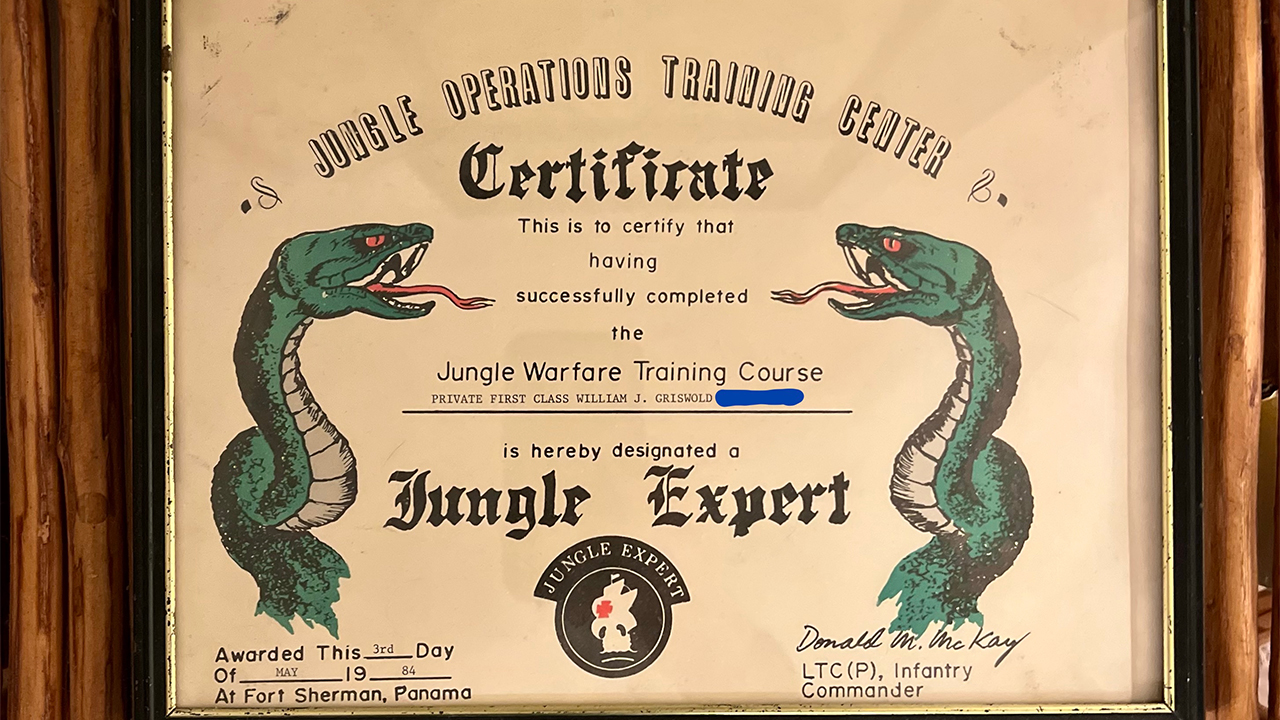

My younger son, aware that my elder son has an interest in investment, wanted to buy him a couple of shares of Ford for Christmas. When the trade went through, the stock was a bit more than $23 a share.

This is our two sons’ first experience with the stock market. Since one is a minor and the other not old enough to trade, I had to open a shared account on AmeriTrade and do the deal for them.

The experience was new to me too. I got to AmeriTrade on the recommendation of a friend, who has a diverse portfolio and said it would be easy and that they charged no fees. Still, I found opening an account daunting: all those cautions and jargon terms of the field, all the legal paperwork and giving over the routing number to the bank account.

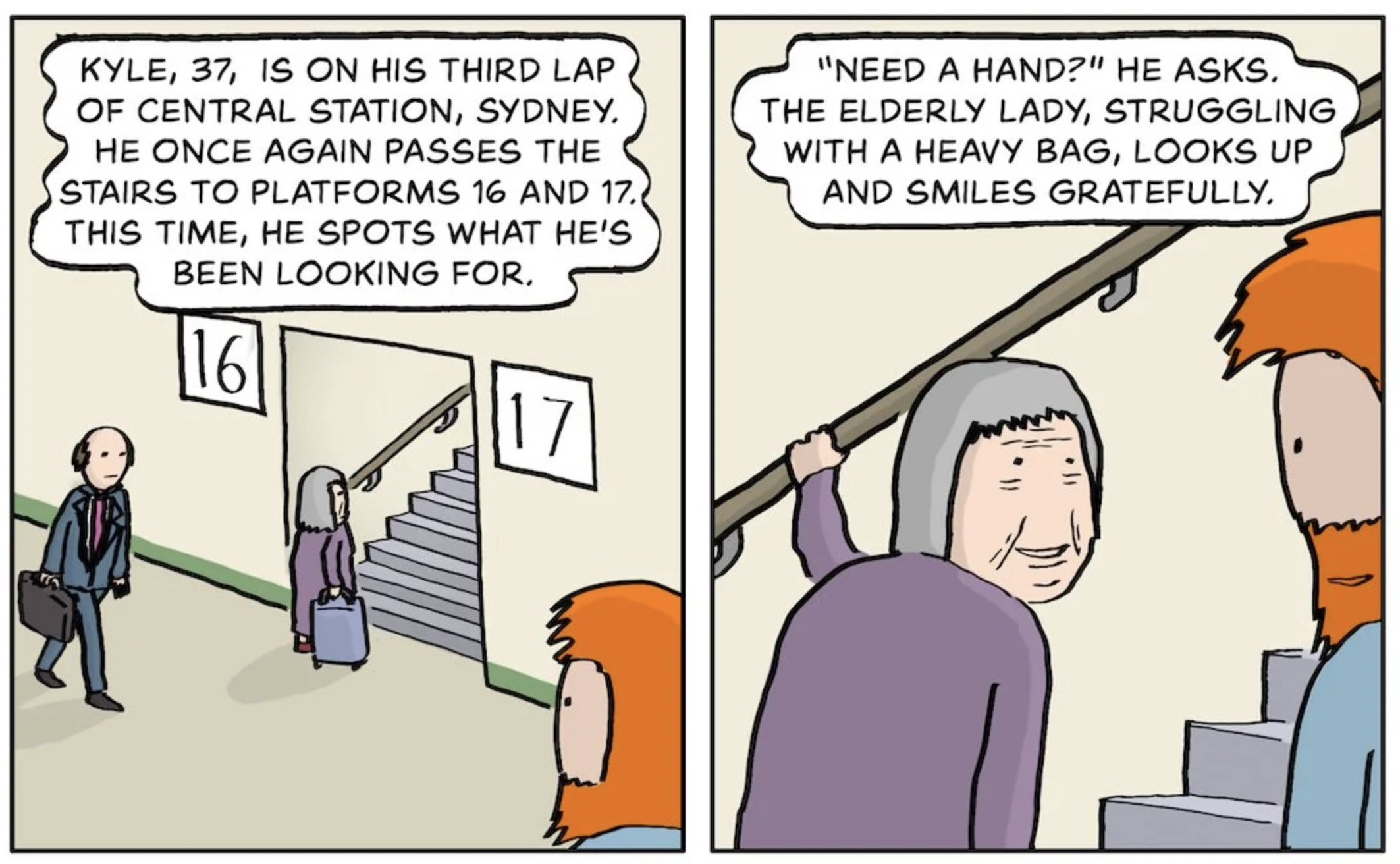

It was also immediately addicting. I spent an hour this morning looking over the site’s learning tools and watching my son’s stock inch up, live, a penny at a time. When I pried myself away, he had made enough to buy several pieces of penny candy. And all for doing nothing but having 50 bucks to invest! No labor! Gee, the capitalist life is swell!

It is not that I have not “put my money to work for me,” as those who have money like to say. We own a house, made possible by the VA loan. I have contributed something to 401ks, 403bs, or other retirement funds since I was 28, often when I could not afford deductions from small paychecks. But those came out pre-tax, and someone else managed the money, so I barely gave it a thought for decades.

This barely giving it a thought, yet profiting by it, is a sure sign of privilege. The friend who put me on to AmeriTrade was called in when he started his first job, at a big corporation, and more or less ordered by his kindly manager to open a 401k, though the company did not require it. This simple advice was life-changing; think how most people never get it, even if they have disposable income. (Only 55% of Americans are invested in an IRA, 401k, or the like, and only 35% of us own stocks, bonds, or mutual funds outside retirement accounts.)

The same friend has decided, all these years later, that capitalism is a game, and that he should only ever have played it by investing his money in ways that led directly to more money, instead of buying things he thought might increase in value. He thinks things—objects of art, a business, maybe even a house—are mere intermediaries or amusements now, which take much more work.

After just one morning of heavy trading while lying on my couch I can begin to see his point.