Money Is a Popularity Contest

May 16, 2021

I avoided reading all the early articles about Bitcoin, sure I would not understand them, sure this was only a fad, a blip, an obsession akin to Victorian tulipmania.

Bitcoin is now a $1 trillion asset class using as much energy every year as Sweden.

Next came the fuss about non-fungible tokens, but “fungible” sounded mushroomy, and I had trouble taking seriously something that began with CryptoKitties.

NFT market cap grew almost tenfold between 2018 and 2020.

Even the word “cryptocurrency” put me off, given that “crypto” means hidden, concealed, secret, not evident or obvious. Just what you want your life savings to be. Proponents say it decentralizes the control of finance, eliminates intermediaries, restores anonymity to a world that has lost most of its privacy, and protects freedom. But given that it exists only as a notation on a global ledger and its exchange rate, at least thus far, fluctuates wildly, I find myself nostalgic for shiny pink ceramic piggy banks that jingled when you shook them.

Dogecoin is a cryptocurrency that was founded as a joke eight years ago, beginning with a sarcastic tweet and a meme with a Shiba Inu dog and rainbow-colored Comic Sans text. At this writing, it has a market cap of $93 billion—wait, two hours later, fresher news reports the market cap as $60 billion. It dropped nearly thirty percent while Elon Musk hosted Saturday Night Live. The more earnest Ether, the cryptocurrency of the Ethereum blockchain (a phrase that still sounds like science fiction) has risen by 465 percent since New Year’s Day.

Something real is emerging from all the silliness. It could still be a blip, or it could be permanent. Likely it will land somewhere in between, somewhere significant enough that, no matter how many silly bubbles pop along the way, it will forever alter the way we think about money. Stuck in ancient history, I almost wrote “the way we think about cash”—which has not existed in any meaningful way for quite a while. Yet when the pandemic threatened the supply chain, my husband withdrew actual twenty-dollar bills from the bank just in case all the systems went down.

The Economist just published a special report on govcoin—Fedcoin, an e-euro, all sorts of state-based digital currencies that “promise to make finance work better but also to shift power from individuals to the state, alter geopolitics and change how capital is allocated.” Our proper response, the author says, is “optimism, and humility.” Mine is to run screaming from the room. Andrew, the historian husband who prides himself on his flip phone, startles me by saying he is far more comfortable with the idea of a state-backed digital currency than one with only market demand setting its value. “Our money has not been tied to gold or anything else tangible since the Seventies,” he reminds me.

In grade school, I learned wistfully about the days when conch shells and beads were traded. The gold standard was harder to wrap my head around, but at least it assured me that flimsy green paper had an anchor. I remember hearing the phrase “cashless society” and thinking the world would grind to a halt. Now I am panicking about the dollars we have carefully saved, afraid it will be like Berlin after the war, and we will carry baskets of them to the digital natives and beg for a bit of bitcoin in exchange. As usual, I am catastrophizing. But it does seem that, left to the whims of a free market, this non-stuff will be subject to the sort of wild fluctuations that presage crashes.

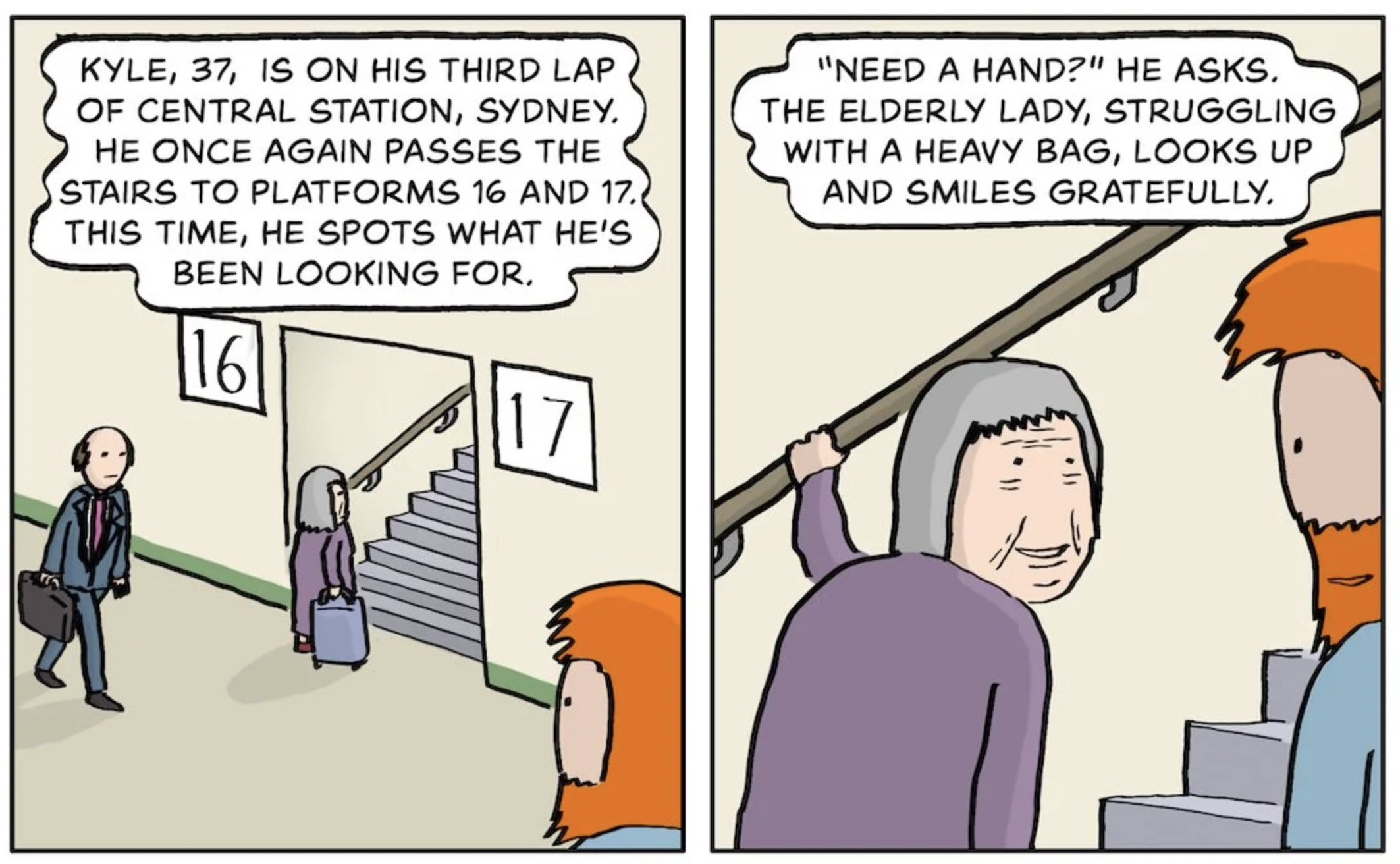

Sociologist Duncan Watts tells us that in viral culture, it is impossible to predict what will become popular. Anyone who has attempted online journalism in the past decade will flinch, remembering the “Blow-Dry Bars” and “How to Wear Leggings” stories that outclicked serial murders. With a certain kind of toehold, content can scale a mountain in half a second. “Tiny, random fluctuations can blow up,” Watts wrote, “generating potentially enormous long-run differences among even indistinguishable competitors.”

Success, in other words, is random, and there is little you can do to earn it. Value soars for extrinsic reasons, not because something is wonderful but because it has landed in a way that gives it social influence. Yes, La Gioconda has an intriguing smile—but is she a meme? (She might be, actually. But DaVinci did not paint her for that purpose; nor did he expect a world in which creation would exist in electricity rather than oil paint and art’s measure would be how far it travels online.)

No doubt Beeple is talented, but it is not his artistry that explains and justifies the $69 million price tag of one of his digital originals, the first NFT auctioned by Christie’s. And how does a guy name his minted digital currency SCAMcoin (Simple Cool Authentic Money) and still sell enough to jack its price to a $70 million market cap (for a minute, until it plummeted to $2.5 million, which is still not bad for a joke).

How did we get here?

The 2008 financial crisis killed compound interest, making it feel pointless to save money in traditional ways. The pandemic cut a lot of young people’s expenses (bars, restaurants, travel, entertainment), freeing cash they wanted a fun way to invest. Suddenly you had GIF memes, tweets, and even a New York Times column being sold as protected originals for vast sums of money.

We need ways to protect original work. The slippery online world made it too easy to steal. But groping toward new systems has taken us to a place where anything can be monetized, and where we are giving things abstract value by saying they are unique when in fact they can be perfectly copied. Instead of owning digital originals, why not royalties for the creator when their work is clicked on a certain number of times? Ah, but who would pay? Could we all be charged a fraction of a cent every time we use a gif or share a story? We need money pumped into this digital marketplace that began as a free-for-all. Clicks were the first currency, and it was not enough. But clearly, it is our collective attitude that adds (or subtracts) value.

Digital originals and currencies could give us a world that is more flexible, uncensored, and democratic. But they will also give us a world in which the very currency by which we live changes value by the minute and nothing can stop it from collapsing. Why, at a time when the pace of change has outstripped our brains and bodies, leaving us overstimulated, stressed, divided, uncertain, and easily fooled or panicked, would we rush to destabilize our most basic means of exchange? To feel cool and get rich quick, I mutter to myself. But a venture capitalist writing in the Harvard Business Review points out that for some, digital currency is a way “to escape monetary repression, inflation, or capital controls.”

That sounds dandy. But something else puzzles me: Why, when we are finally accepting the fact that we are fast bringing about our own demise on this planet, would we embrace a system that will exponentially accelerate the climate crisis? Bitcoin emissions alone could push global warming above two degrees Celsius, warns an oft-cited article in Nature. Its blockchain uses deliberately energy-intensive “mining” to prevent fraud.

The HBR article points out that mining can be done anywhere, using excess energy that would otherwise go to waste, like hydro energy during the wet season in Sichuan. But I am too cynical to believe the moneychangers will be that diligent. We schlep glass bottles to the town recycling center and sort cardboard from gooey garbage for alternating pickups—knowing full well that much of it will end up in a landfill anyway, because we humans cannot seem to keep up with our nuclear waste, our toxins, our beloved plastics. All this earnest individual effort matters only philosophically, because the giants drown our incremental progress with a single gush of carbon.

The HBR writer points out that emissions will not remain at these astronomical levels, adding that “if profit margins fall, the financial incentive to invest in mining will naturally decrease.” But the energy-intensive mining is supposed to be what makes the system safe! Here is the rub: The best-known, most solid cryptocurrencies are “old” now, and their methods gobble the most energy. Ethereum is hybrid, trying to use less energy and emit less carbon, yet it still used more energy than all of Iceland in 2018. Newer cryptocurrencies claim to be more sustainable—but are they as reliable?

For those as clueless as I, the confusion has made at least one thing clear: Money is a construct, real but not substantive, fickle even in the safest of hands. Value is a moving target. Our lives are pulled along by strings of code—our DNA, the work and data and images we store on a computer, the apps that organize and amuse us, the RNA vaccines that immunize us, the NFTs we invest in just to sell them later, because who wants to show dinner party guests an original art collection that lives in a computer?

Napoleon said truth was what people believed to be true, and we are proving that daily. At least the craziness has whooshed away the last shreds of Calvinism, revealing the total disconnect between wealth and virtue. The minute collectors begin to take themselves too seriously, we can point out that the use of NFTs for luxury investment began with a pixellated cat with the body of a Pop Tart.

Read more by Jeannette Cooperman here.