Investing in Royalties

August 7, 2021

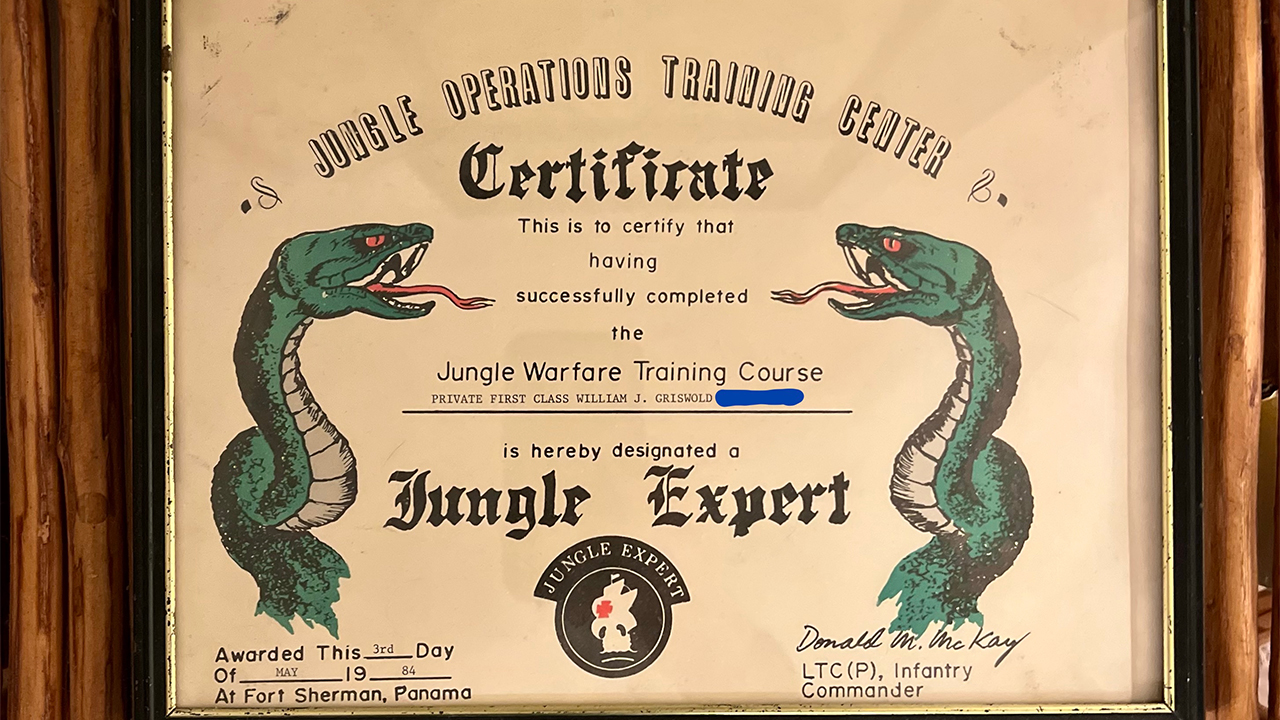

Remember when Michael Jackson bought publishing rights to songs by The Beatles, Springsteen, Elvis, the Stones, and others? He did so, famously, after Paul McCartney, collaborator and once-friend, told him it was a good investment. Then Macca spent 35 years trying to get the rights back to some 250 Beatles songs.

Surprisingly, anyone can participate in this sort of investing, though prices vary wildly. A young financial analyst for Google, who runs a website for young people who would like to invest beyond retirement accounts, lists “royalties” as number seven on his “19 Best Income Generating Assets [Invest in Cash Flow, 2021].”

He points to a site called Royalty Exchange that sells not just publishing rights for songs, but also royalties on films such as Trading Places; books; premium stock video footage; mouthwash; and even Ben & Jerry’s Cherry Garcia ice cream.

Each of these, as you might expect, are limited, strictly-defined assets. With the ice cream, what you are buying is, “Ten years of payments generated by the seller’s interest in the domestic (U.S. only) royalties derived from the licensing of the Cherry Garcia trademark.” (Ben & Jerry’s is now a subsidiary of Anglo-Dutch conglomerate Unilever.) The rights sold for $50,750, but they earned only $6,767 in the last 12 months.

A better investment, perhaps, was Jay-Z’s “Empire State of Mind,” which won two Grammys and went multi-platinum. The closing price was $190,500, but these rights made almost $33,000 last year, so over the 10 years of the investment term, it seems possible a good profit will result. Again, what the buyer got, specifically, was “musical composition” (but not copyright or “sound recording”) to include “public performance” on “Internet Streaming, AM/FM & Satellite Radio, TV/Film/Commercial Performances, etc.”

Remember the film Dirty Dancing’s song “(I’ve Had) The Time of My Life”? It still earned $47,000 last year, most of that overseas. Someone bought it for $493,000.

Cheaper properties include a portfolio of “streaming hip-hop featuring J. Cole,” for $11,500; a “contemporary Christian and gospel collection,” on the secondary market, with less than eight years remaining, for $6,000; and a “diverse R&B catalog” for $8,804.

On the investment site for youth, the number-six recommended investment, above royalties, is certificates of deposit.