Adversarial Capitalism: The Corporation and the Public Good

How a president and a business titan shaped the battle between government and private finance.

September 11, 2020

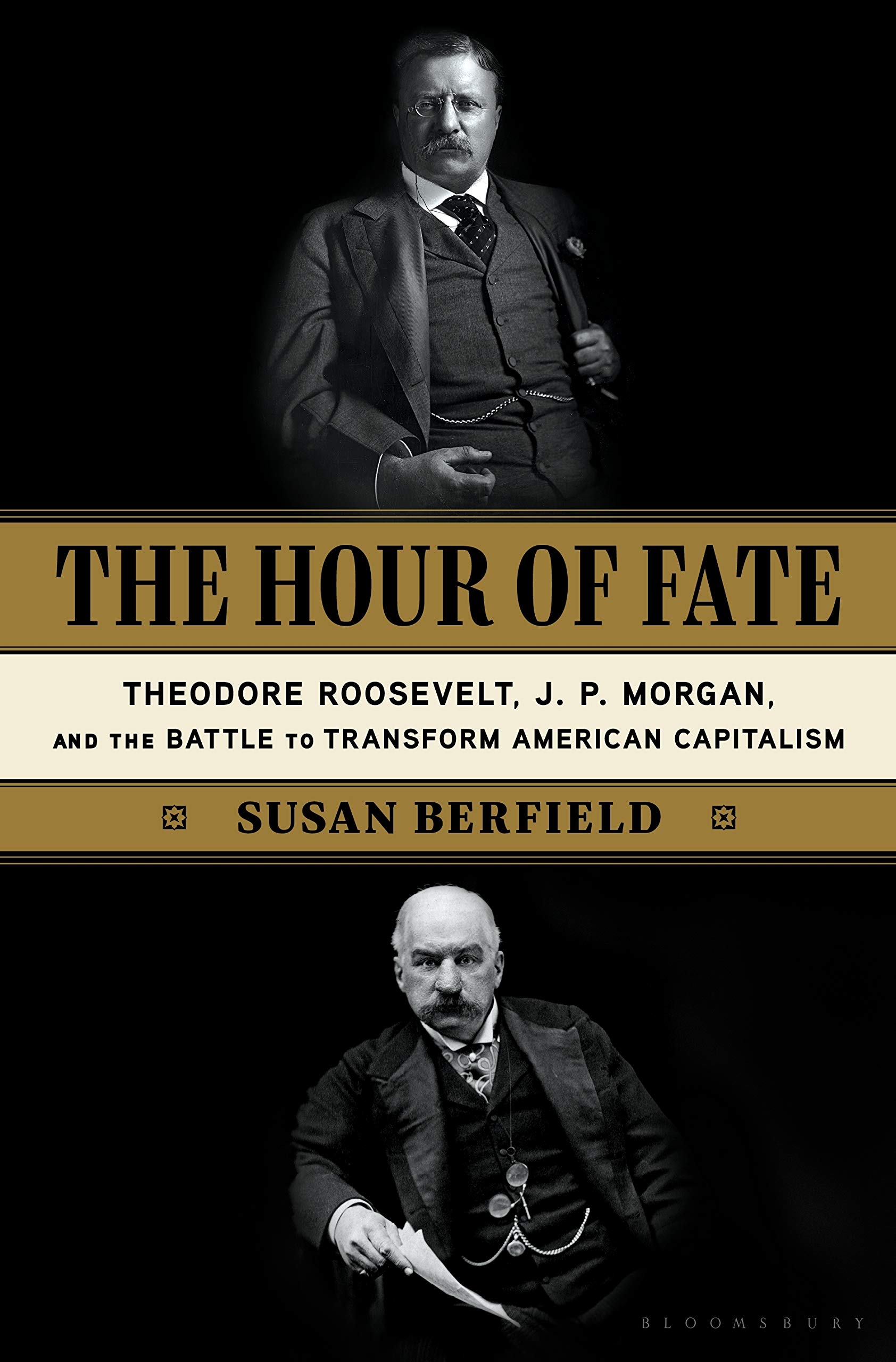

The Hour of Fate: Theodore Roosevelt, J.P. Morgan, and the Battle to Transform American Capitalism

As trustbusting and the debate about the size and clout of businesses return to the national discussion, it is important to note that many of the talking points are not new. In The Hour of Fate, Susan Berfield masterfully chronicles the lives and interactions of the two antagonists in one of the country’s first important antitrust battles.

Shortly after taking office following the assassination of President William McKinley, President Theodore Roosevelt decided that the government needed to strengthen its efforts to go after illegal corporate practices that stifled competition and hurt consumers by raising prices on essential goods. Nobody embodied big business and its vice-like grip on the economy better than J.P. Morgan. A clash between the two was inevitable.

Their relationship was cordial, though never warm, and they eyed each other warily. Think Muhammad Ali and Joe Frazier, without the physical strength and with better manners.

“Morgan and Roosevelt both knew privilege and loss, though they would have balked if anyone had pointed out their similarities. They were a generation apart, but that wasn’t the only explanation for the essential differences in how they perceived their shared experiences,’’ she writes. (8)

The Morgan-Roosevelt saga gives Berfield a lot to work with, and Berfield follows the age-old advice to show and not tell.

“I am afraid of Mr. Roosevelt because I don’t know what he’ll do,’’ Morgan said. Roosevelt replied: “He’s afraid of me because he does know what I’ll do.”¹

The Morgan-Roosevelt saga gives Berfield a lot to work with, and she follows the age-old advice to show and not tell. As a result, her book reads like a novel and she proves the adage that truth can be just as engaging as fiction. This is no small feat given that there are extensive discussions of century-old legislation and litigation, which only a true antitrust nerd, such as this writer, can love.

Morgan was quite shy, conservative in every part of his life, and felt offended when others second-guessed his belief that when it came to business, big was inevitably better. The Episcopal vestryman who gave generously to charity, was admired more than liked.

Roosevelt was a reformist blueblood with an insatiable intellectual curiosity (he wrote thirty-five books) who always needed to be the center of attention. He admired businesses and businessmen, but felt that society would be irreparably damaged if the government did not clamp down hard on corporate excess.

In his December 1901 message to Congress, Roosevelt stated that large companies should be “supervised and within reasonable limits controlled.” ²

Unlike his predecessors, Roosevelt made it clear from the start that he would be vigorously enforcing the federal antitrust law, the Sherman Act. His Department of Justice targeted Morgan’s Northern Securities, a railroad trust established by combining the businesses of Morgan and his rivals. Morgan controlled all of the nation’s major railroads, as a result of his deals with other business leaders such as John D. Rockefeller, E.H. Harriman, and James J. Hill.

“The railroads’ influence seemed unbounded; now the justices would determine whether these already massive corporations could continue to consolidate power. By 1903 their combined stock value represented one-eighth of the wealth of the country,’’ Berfield writes. (231)

In one meeting between Roosevelt and Morgan and their aides, Morgan said, “If we have done anything wrong, send your man to my man and they can fix it up.”

Attorney General Philander Knox said that would not be happening since they planned to file suit.

Berfield chronicles the contrasting courtroom styles of the government’s and Morgan’s lawyers. And at the Supreme Court, the government prevailed 5-4.

“The combination here in question may have been for the pecuniary benefit of those who formed or caused it to be formed. But the interests of private persons and corporations cannot be made paramount to the interests of the general public,” Justice John Harlan wrote for the court. “Under the Articles of Confederation commerce among the original states was subject to vexatious and local regulations that took no account of the general welfare. But it was for the protection of the general interests, as involved in interstate and international commerce, that Congress, representing the whole country, was given by the Constitution full power to regulate commerce among the states and with foreign nations.’’³

During its seven-and-a-half years, Roosevelt’s administration prosecuted forty-four antitrust cases and cemented his reputation as the nation’s first trust-busting chief executive. He also laid the groundwork for strong antitrust enforcement by his successor, William Howard Taft. And Taft’s successor, Roosevelt’s bête noire Woodrow Wilson, created the Federal Trade Commission, which gave the government additional tools to fight economic concentration by large companies.

During its seven-and-a-half years, Roosevelt’s administration prosecuted forty-four antitrust cases and cemented his reputation as the nation’s first trust-busting chief executive.

In going after monopolies, Roosevelt and others were putting the sentiments of Senator John Sherman, the business-friendly Ohio Republican who wrote the first federal antitrust law, into action. The Northern Securities case was one of the first big tests of the law.

During the Senate’s debate in 1890 on the bill that became the Sherman Act, the lawmaker described a trust as “a kingly prerogative, inconsistent with our form of government. If we will not endure a king as a political power, we should not endure a king over the production, transportation and sale of any of the necessaries of life.” ⁴

Sherman and Roosevelt had men such as Morgan in mind when they beefed up the country’s antitrust enforcement.

Morgan and Roosevelt were not always at odds, and the business leader did several things to help the Roosevelt administration. Morgan helped Roosevelt settle a 164-day nationwide coal strike that was crippling the economy, provided capital for the Panama Canal (one of Roosevelt’s top priorities), and rescued financial institutions during the Panic of 1907.

The 1902 coal strike, which gave Roosevelt an opportunity to intervene and gain publicity and credit, was also an opportunity for business and government to work together to resolve a labor-management standoff.

“The president knew that even as he had created a new role for the government in labor disputes, he couldn’t have done so without the biggest of the titans: Morgan. In the moment—and even more so, as the years went on—Roosevelt considered his intervention in the strike one of the great achievements of his presidency,’’ Berfield writes. (188)

The book does not touch on the Panic or the Panama Canal, but those topics are covered masterfully in other works, especially David McCullough’s The Path Between the Seas (1977).

Berfield, an investigative reporter for Bloomberg Businessweek and Bloomberg News, is great at bringing events that took place 120 years ago to life. But if you read the headlines, you will think that history is repeating itself. The vast wealth disparities and the market concentration of a few companies—Amazon, Facebook, and Google—have caused many to argue that we are in another Gilded Age, the phrase coined by Mark Twain to describe the period in which Morgan and Roosevelt ruled the roost.

Leaders of both parties are trying to demonstrate their trust-busting credentials.

The Trump administration tried, albeit unsuccessfully, to block the merger of AT&T and Time Warner. The Department of Justice is working with state enforcers of both parties to investigate Google for antitrust violations. Part of the focus is the firm’s dominance in online search and advertising.

The House Judiciary Committee is conducting an investigation into the practices of technology platforms that could lay the groundwork for passing legislation that could strengthen the nation’s antitrust laws.

From the grave, Morgan is fuming and Roosevelt is smiling.

Berfield, an investigative reporter for Bloomberg Businessweek and Bloomberg News, is great at bringing events that took place 120 years ago to life. But if you read the headlines, you will think that history is repeating itself.

Once the coronavirus pandemic ends, you can step back in time and visit the magnificent residences of these two larger-than-life men.

Morgan’s home and library, a majestic building on Madison Avenue in New York City, designed by famed architect Charles McKim, contains rare books (including several Gutenberg Bibles), original classical music manuscripts, and fine art.

Forty miles east, in Oyster Bay, New York, is Roosevelt’s home, Sagamore Hill. It is filled with many of his books (he often read two a day), as well as animal heads and skins from his hunting expeditions.

Both homes are so authentic that you think their former owners might drop by while you visit. You would no doubt be a bit intimidated by Morgan, who would offer you tea and engage you in an interesting, though quite proper, conversation. By contrast, Roosevelt would discuss his latest literary find or hunting expedition, make you feel like he has known you forever, and might even suggest a game of football on the front lawn.

While those visits have to be put on hold, reading The Hour of Fate: Theodore Roosevelt, J.P. Morgan, and the Battle to Transform American Capitalism is an engaging and enjoyable way to learn about these men and the seminal era they both did so much to shape.

1 Hearst’s Magazine: The World To-day, Volume 22, p. 148.

2 Theodore Roosevelt, First Annual Message, December 3, 1901.

3 U.S. Reports: Northern Securities Co. v. United States, 193 U.S. 197 (1904), p. 156.